DOMS Industries Limited IPO Details:

Estimated Pre-listing Market Cap: ~4,793Cr

IPO Date: 13th December to 15th December

Total shares: ~6 Cr

Price band: Rs. 750 - Rs. 790 per share

IPO Issue Size: ~ Rs. 1,200 Cr

Lot Size: 18 shares and multiples thereof

Purpose of Issue: Offer for Sale by Promoters

About DOMS Industries Limited:

Doms Industries engages in the design, development, manufacturing, and sale of a diverse range of stationery and art products. These products are primarily marketed under the flagship brand 'DOMS' and are distributed both domestically and internationally (20%+ revenue share), spanning over 45 countries. In India's branded stationery and art products market, Doms holds the position of the second-largest player, boasting a market share of ~12% by value (as of FY23). The company's success can be attributed to its dedicated focus on R&D, product engineering, and vertically integrated manufacturing operations.

In 2012, the company teamed up with Fabbrica Italiana Lapis ed Affini S.p.A. F.I.L.A. (current promoter), an Italian multinational in art and stationery. FILA, a big player with USD 0.84 bn in revenue helped the company reach global markets and boost research and tech capabilities. This partnership expanded the company's presence in the US and Europe, promoting the 'DOMS' brand worldwide. Also, they have an exclusive deal with FILA for distributing and marketing their products in India, Nepal, Bhutan, Sri Lanka, Bangladesh, Myanmar, and the Maldives.

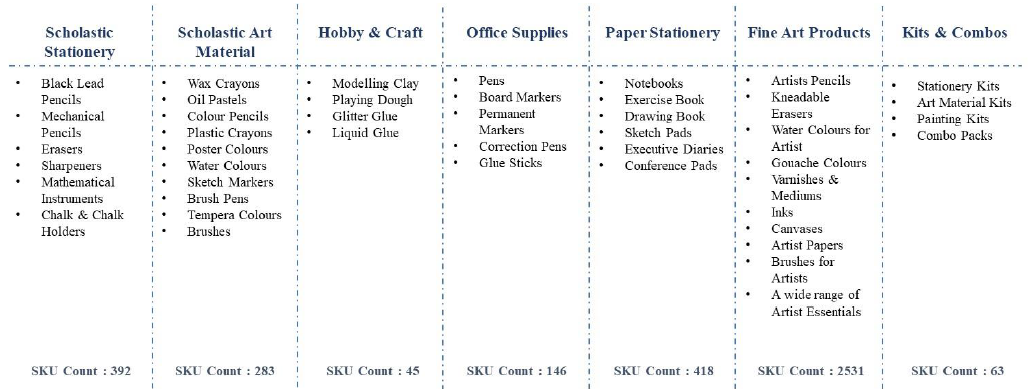

Key products:

Category-wise products and revenue breakup

Acquisitions to enter new segments:

In FY16, Doms Industries bought a 49% share in Pioneer Stationery Pvt Ltd for Rs. 2.1 crores to expand into paper stationery. Later, the stake was increased to 51%. In FY17, they acquired a 35% share in Uniwrite Pens and Plastics Pvt Ltd for Rs. 2 crores to enter the pen segment, later increasing the stake to 60%. In February '23, Doms acquired a 30% stake in Clapjoy Innovations Pvt Ltd for Rs. 1.5 crores, mainly involved in making wooden board games and educational toys. In August '23, they acquired a 75% majority stake in Micro Wood Pvt Ltd, a company making decorative tin boxes and paper packaging products, for Rs. 70.5 crores.

Distribution network with pan India presence:

The company's main distribution network in India for general trade (70%+ revenue) involves super-stockists and distributors, supported by a dedicated sales team comprising over 500 members. It manages seven warehouses and three depots. It has established partnerships with over 120 super stockists and more than 4,000 distributors covering more than 120,000 retail touch points across 3,500 cities and towns, reaching 28 states and 8 union territories.

Peers -In the organized sector, Doms faces competition from companies such as BIC Cello, Flair Writing Industries, Hindustan Pencils, Kokuyo Camlin, Linc, Luxor Writing Instruments, Navneet Education, and Rorito International.

Objects of issue

1. Offer for Sale: Both promoters are offering their shares for sale in the IPO. FILA is offering shares worth Rs. 800 crores to investors while Sanjay Rajani and Ketan Rajani are offering shares worth Rs. 25 crores each.

2. Fresh Issue: The company aims to raise Rs. 350 crores through the IPO, of which Rs. 280 crores will be utilized for new capacities, while the rest will be used for general purposes.

- The total cost for building new capacities is estimated to be Rs. 454 crores, for which the land has been acquired at a cost of Rs. 74 crores, leading to a total capital requirement of Rs. 380 crores (over FY24-26). The deficit of Rs. 100 crores between the cost of the project and the available financing will be bridged by internal accruals.

3. Financials / Performance

Concerns

1. Technological advancement- Doms faces the risk of technological advancements in the stationery sector, especially with the current trend of moving from traditional classroom learning to online learning. This shift was mainly triggered by the COVID-19 outbreak, which forced the closure of educational institutions globally and led to the widespread adoption of remote digital learning methods.

2. Supplier concentration risk- The company faces potential issues due to the absence of a solid contract with suppliers. Without clear agreements, problems like delayed deliveries and insufficient parts may arise. While the number of suppliers increased from 468 to 640 between FY21 and H1FY24, the contribution of the top 5 suppliers increased from 19.5% to 23%.

3. Increase in Advertising Spends – An increase in competition may necessitate an increase in Doms' spending on sales and marketing efforts. The costs for advertising and business promotion were 0.37%, 0.41%, 0.28%, and 0.33% of the revenue from operations in FY21/22/23 and H1FY24 respectively.

4. Related party transactions stood at 33% in FY21 which has gone back to 38% in H1FY24 (vs. 24/21% in FY22/23). While these transactions are on an arm’s length basis and approved by the board, one needs to be cognizant of these transactions.

Management

1. Gianmatteo Terruzzi is the Chairman and Independent Director of the company. He holds a degree in Economics and Business from the Universita Cattolica Del Sacro Cuore, Milan. He is not associated with FILA, the corporate promoter, in any capacity.

2. Santosh Raveshia is the Managing Director and one of the individual promoters. He has been associated with the company since its incorporation as a Director and Promoter.

3. Sanjay and Ketan Rajani, both are Whole Time Directors and individual promoters.

4. Chandni Somaiya: At 50 years of age, she is a Whole Time Director and one of the individual promoters of the company.

Opinion:

Doms Industries has delivered strong growth in the last 2 years (70%+) on a low COVID base, it has positives like (a) the Strong parentage of Fila group with an opportunity to tap the export market having a low cost of production, (b) Optimized working capital (materially lower than peers; 40 days vs average 70 days +) on advanced collected from super stockist (main distribution channel), (c) Fully integrated operations in key segments (pencils; 30%+ revenue share), (d) scale-up of segments such as office supplies, hobby and craft items, fine art products (<10% revenue share).

However, the company is currently seeking a valuation (43x P/E) expensive to its peers (<40x P/E) at peak margins and highest sales (COVID base).

Recommendation: Avoid, as growth is already priced in.

DOMS Industries Limited IPO Tentative Timetable:

| IPO Activity | Date |

| IPO Open Date | Dec 13, 2023 |

| IPO Close Date | Dec 15, 2023 |

| Basis of Allotment Date | Dec 18, 2023 |

| Refunds Initiation | Dec 19, 2023 |

| A credit of Shares to Demat Account | Dec 19, 2023 |

| IPO Listing Date | Dec 20, 2023 |

Retail Individual Investor IPO Lot Size:

| Application | Lots | Shares | Amount |

|---|---|---|---|

| Minimum | 1 | 18 | Rs. 14,220 |

| Maximum | 14 | 252 | Rs. 199,080 |

DOMS Industries Limited IPO FAQs:

1. When will the DOMS Industries Ltd IPO open?

DOMS Industries IPO will open for subscription on Wednesday, 13th December 2023, and closes on Friday 15th December 2023.

2. Should you apply to DOMS Industries IPO?

No, as growth is already priced in.

3. What is the price band of DOMS Industries Ltd IPO?

The price band for DOMS Industries Ltd IPO is Rs. 750-790/share.

4. What is the lot size for the DOMS Industries Ltd IPO?

Retail investors can subscribe to the IPO minimum lot size is 18 shares, up to a maximum of 14 lots i.e. Rs. 1,99,080/-.

5. What is the issue size of DOMS Industries Ltd IPO?

The total issue size is ~ Rs. 1,200 Cr.

6. When will the basis of allotment be out?

Allotment will be finalized on December 18th and refunds will be initiated by December 19th. Shares allotment will be credited in Demat accounts by December 19th.

7. What is the listing date of DOMS Industries Ltd’s IPO?

The tentative listing date of the DOMS Industries IPO is December 20th, 2023.

8. What if I do not get the allotment?

If you do not get an allotment of this IPO we recommend you to check out our MoneyWorks4me Core Superstars which helps you build a strong portfolio right away. It offers a Model Portfolio of high-quality stocks Buy/Sell alerts on Quality stocks at a reasonable price and SIP recommendations on stocks. With the help of MoneyWorks4me Core Superstars, you would have picked winners like Asian Paints, Divis Labs, Titan, Pidilite, Cipla, Bharti Airtel, and ICICI Bank.

Already have an account? Log in

Want complete access

to this story?

Register Now For Free!

Also get more expert insights, QVPT ratings of 3500+ stocks, Stocks

Screener and much more on Registering.

Comment Your Thoughts: